Revaluation Project 2021-2022

The Town of Falmouth commenced its revaluation of all real estate beginning in January 2021. The revaluation will be completed by August 2022. The results of the revaluation will be applied to November 2022 property tax bills. Under the supervision of Cumberland County Regional Assessing, the Town has contracted with Vision Government Solutions to perform this work. The Town of Falmouth has created this Revaluation Project Page which will include updates as the revaluation project progresses. This Revaluation Project Page can be accessed via the home page of the Town website. Additional updates can be found via our social media pages, The Falmouth Focus newsletter, and in our regular Forecaster ads.

Click here for our Revaluation Fact Sheet

New FAQ Guide Regarding the Assessing Process and Methodology of Determining an Assessed Value

Table of Contents

Most Recent Update | Basic Project Info | Project Schedule | Inspections | New Assessments: Q&A | Will My Taxes Go Up? | Property Tax Exemptions & Assistance | Health & Safety | Additional ResourcesUpdate September 15, 2022

The assessor has committed taxes and the mil rate for FY23 will be 11.92. Residents may calculate their property tax bill using the following formula:

Assessed value x mil rate = tax bill (for example, $500,000 x .01192 = $5,960). Please note: this calculation does not include any exemptions for which you may qualify that would lower your bill.

Property tax bills will be mailed out in late September and the deadline for payment is November 3, 2022.

Update August 9, 2022

At the Town Council meeting on August 8, Assessor Ben Thompson presented an update on the revaluation, accompanied by David Cornell, an independent consultant hired to provide a quality review of the revaluation and analytics of the data collected. Find the presentation and video of the meeting here.

The last opportunity for residents to request an informal hearing with an assessor to discuss their new assessment was August 8. In the coming weeks, the assessor will establish the new mil rate (known as the commitment). Property owners who still disagree with the newly assessed value of their property will have 185 days after the commitment to file an abatement with the Assessor’s Office.

While numbers are not yet finalized, the assessor believes the new mil rate will fall within the range of .01180 to .01230. This is a tentative estimate and not a finalized mil rate. Residents may estimate their tax bill by using the following formula: Assessed value x estimated mil rate = estimated tax bill (for example, $500,000 x .01200 = $6000). It cannot be stressed enough that this is a TENTATIVE range and NOT the new mil rate. The mill rate CANNOT be established until all assessed property values are finalized—which requires the informal appeals process to be completed. Residents have questions regarding the impact of the revaluation on their property taxes and, by offering this range, the assessor hopes to address some of these concerns.

Basic Project Information

WHAT IS A REVALUATION? During a revaluation, all real property in the town is reviewed and assessments are adjusted to their fair market value. A revaluation is the process of conducting the data collection and market analysis necessary to equalize the values of all properties within a municipality for the purpose of a fair distribution of the tax burden.

WHAT HAPPENS DURING A REVALUATION? A revaluation project begins with a Data Collection phase. Falmouth will undergo a Full Data Verification Revaluation. Data verification is accomplished through a physical inspection of both the interior and exterior of each property. Improvement dimensions and characteristics are noted.

While the Data Collection phase is going on, appraisers also study property sales and determine where the actual increases and decreases in value are occurring. This study of property sales occurs over a 12-month period prior to April 1, 2022. Appraisers make comparisons and establish parameters to estimate the value of property that has not been sold. The appraisers then review this collected data and apply the determining factors of the sales analysis to value of each property.

WHY CONDUCT A REVALUATION NOW? Revaluations ensure fairness to all property owners. Falmouth’s last revaluation occurred in 2009. Over time, different properties increase in value at different rates. For example, the market may favor condos over single family homes or ranches over colonials. This can result in inequities. The revaluation equalizes all property values making property taxes more equitable for everyone.

Project Schedule

| Exterior Data Collection of Properties | January 2021-February 2022 |

| Interior Data Collection of Properties | July 2021-May 2022 |

| Land Study and Building Cost Study | January 2022-May 2022 |

| Field Review | March 2022-June 2022 |

| Commercial Study of Market Rents, Expenses & Capitalization Factors | April 2022-June 2022 |

| Deliver Residential & Commercial Values to Assessor | June 2022 |

| Assessor Review of Values | June 2022 |

| Assessment Hearing Notices Mailed | Late June 2022 |

| Informal Hearings and Hearing Changed Notices Mailed Out | July 2022 |

| Finalization | August 2022 |

| Project Completion | August 2022 |

Inspections

AM I REQUIRED TO ALLOW AN INSPECTOR INTO MY HOME? No. Interior inspections are only performed with the owner’s permission. While it is not mandatory for residents to allow inspectors interior access, the data they are collecting is important to the accuracy and uniformity of the assessments.

HOW IS AN ESTIMATE MADE IF THE ASSESSOR IS NOT GIVEN ACCESS TO THE INTERIOR OF MY HOME? WILL THE VALUE BE BASED UPON THE TOWN-WIDE AVERAGE? An assessment will be made based upon all the information that is garnered for each property individually. Estimates are only based on the information available. The more accurate the information, the more accurate the assessment.

WHERE IN FALMOUTH ARE DATA COLLECTORS CURRENTLY WORKING? Data collection has been completed.

New Assessments: Q&A

HOW WAS THE VALUE OF MY PROPERTY DETERMINED? Falmouth has undergone a Full Data Verification Revaluation. Data verification is accomplished through a physical inspection of each property. Over the past 18 months, data gatherers from Vision Government Solutions visited Falmouth properties for exterior and, in many cases, interior inspections. Assessors analyzed data gathered from these inspections and information documented from the last assessment, including the house style, location, neighborhood (if located in one), residential grade (quality), water frontage (including ocean and lake), utilities available, zoning, and usable land. An analysis of market sales between April 2021 and April 2022, replacement costs, and other factors also assist in the valuation of all property to its fair market value. A third-party auditor also reviewed Vision Government Solutions’ work to ensure its quality. For more information: New FAQ Guide Regarding the Assessing Process and Methodology of Determining an Assessed Value

HOW WILL I BE NOTIFIED OF THE NEW ASSESSMENT? New assessment letters were mailed to property owners on July 19. If you do not receive a letter, see “How Can I See My New Assessment?” below or call 207-699-5335.

HOW CAN I SEE MY NEW ASSESSMENT? You may review your new assessment data on the Vision Government Solutions appraisal web site.

- Visit www.vgsi.com and select the “TAXPAYER INFO” tab along the top of the page.

- Choose “ONLINE DATABASES” from the dropdown menu.

- Select the state of Maine symbol.

- Scroll to “Falmouth, ME,” and enter search information for your parcel.

I DISAGREE WITH MY ASSESSMENT. WHAT SHOULD I DO? Property owners may review their new assessment with a representative of Vision Government Solutions by scheduling an informal telephone hearing. The deadline to make an appointment is August 8. Appointments may be scheduled in the following manner:

- ONLINE: Visit www.vgsi.com/schedules, click on “FALMOUTH MAINE HEARINGS,” and follow the instructions. To make appointments for more than one property, please use the number below. If, due to a conflict, you are unable to find an available appointment via the online portal, you may call the toll-free number below. Vision Government Solutions has assured us they will work to accommodate those residents requesting a hearing.

- PHONE: Call toll-free 1 -888-844-4300, 9am-4pm, Monday– Friday. Note: Call center operators taking appointments are not trained nor qualified to discuss home values or assessment data.

Informal hearings will be held primarily by phone however, in-person hearings are available on a limited basis and will be held by appointment in the Town Council Chambers at Falmouth Town Hall. Call the toll-free number above to make an appointment.

If you are unable to attend a hearing by phone or in-person, you may present evidence supporting your opinion of the fair market value of your property to Vision Government Solutions in writing prior to August 8, 2022. Letters should be sent to Vision Government Solutions c/o Appraisal Dept., 1 Cabot Road, Suite 100, Hudson, MA 01749.

WILL I LOSE MY RIGHT TO APPEAL IF I DO NOT ALLOW AN INTERIOR INSPECTION? No. No “penalty” will be assessed for refusal to allow an interior inspection. All property owners have the right to appeal their new valuation by appointment once the informal valuation letter has been received, or by filing for an abatement within 185 days after commitment. The “commitment” is the date the assessor makes a final determination on the new value and calculates the new tax rate.

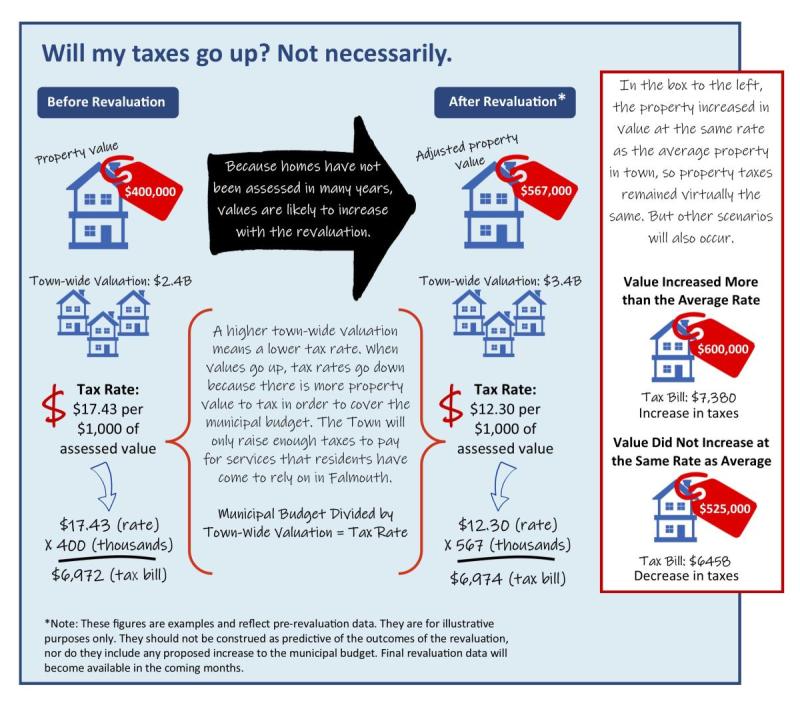

I MULTIPLIED MY NEW ASSESSMENT BY THE TAX RATE. IS THIS MY NEW TAX? No. The new assessment value indicated in your property assessment letter does not include any exemptions or tax credits. Moreover, the tax rate for the 2022-2023 tax year will not be established until August. Multiplying by the current rate will not be a true reflection of your upcoming property tax bill. The new rate will be lower due to a higher town-wide assessed value. See graphic below, “Will My Taxes Go Up?”

IS THE REVALUATION AN OPPORTUNITY FOR THE TOWN TO RAISE ADDITIONAL TAX REVENUE? No. The revaluation process is revenue neutral. Municipalities do not gain additional tax revenue by increasing the town-wide value of real property. The Town will only assess the taxes necessary to meet annual approved budget expenditures. The revaluation process takes the existing budget and apportions it among property owners with improved equity. See the graphic below, “Will My Taxes Go Up?”

WILL MY TAXES GO UP?

Property Tax Exemptions & Assistance

Make sure you are taking advantage of all the programs and assistance available to you. There are several property tax exemptions and assistance programs available to qualifying residents, including the Homestead Exemption, Veterans Exemption, and Senior Tax Assistance Programs.

- Falmouth’s Senior Property Tax Assistance Program

- Property Tax Exemptions

- Property Tax Relief Programs

NEW PROPERTY TAX LAW FOR SENIORS During its most recent session, the Maine Legislature passed a law that allows certain senior residents to stabilize, or freeze, the property taxes on their homestead. The State will fully reimburse municipalities for lost revenue. The law goes into effect on August 8, 2022 and applies to property tax years beginning April 1, 2023. Find more information at: https://www.maine.gov/revenue/taxes/tax-relief-credits-programs/property-tax-relief-programs/stabilization-program.

Health & Safety

HOW WILL SAFETY AND SOCIAL DISTANCING BE MAINTAINED DURING AN APPRAISAL? Data Collectors have been trained in all CDC recommended health and safety protocols. They will always wear masks and maintain six feet of distance from home owners. Interior inspections will not begin until summer 2021 and continue into 2022.

HOW WILL I IDENTIFY A DATA COLLECTOR? All data collectors working on Falmouth’s revaluation project work for Vision Government Solutions of Hudson, Massachusetts. Most of the data collectors conducting Falmouth’s revaluation live in Maine and will drive vehicles with Maine license plates. In some cases, however, a data collector may use a vehicle with out-of-state plates. In ALL cases, every data collector vehicle will be marked with the name and/or logo of Vision Government Solutions (see logo below). Data Collectors will be dressed in bright yellow vests and will be wearing a lanyard and photo identification badge. They will also have a letter of authorization from the Town of Falmouth. If at any time, you are suspicious of an individual asking for entry into your home, you may contact Falmouth Police Department at their non-emergency number (207-781-2300) for verification.

Additional Resources

Vision Government Solutions, Inc.

General questions may be directed to Cumberland County Assessing at: 207-699-2475 or the Town of Falmouth at 207-699-5335.